2024: China's Goods Trade Up in Volume, Growth, and Quality

Faced with the complex and severe situation of increasing external pressure and internal difficulties, China's economic operation will be generally stable in 2024,and new quality productivity will develop steadily. Dividends of listed companies will hit a new high, investors' sense of gain will be significantly enhanced, and the international status of the RMB will be further enhanced.

2024 is a critical year for achieving the goals and tasks of the 14th Five-Year Plan. Faced with the complex and severe situation of increasing external pressure and increasing internal difficulties, China's economy has achieved encouraging results. As summarized by the Central Economic Work Conference held in December 2024, in 2024, "the overall economic operation is stable, with steady progress, high-quality development is steadily promoted, and the main goals and tasks of economic and social development are about to be successfully completed. New quality productivity has developed steadily, reform and opening up have continued to deepen, risks in key areas have been resolved in an orderly and effective manner, people's livelihood has been solidly and effectively guaranteed, and China's modernization has taken new and solid steps. The development process over the past year has been extraordinary and the achievements are encouraging, especially the decisive deployment of a package of incremental policies at the meeting of the Political Bureau of the Central Committee on September 26, which effectively boosted social confidence and significantly rebounded the economy."

In 2024, China's economic operation was generally stable, residents' income continued to grow, consumption recovered steadily, investment scale continued to expand, exports maintained good growth, trade structure continued to be optimized, and the employment situation was generally stable. Especially since September, after a series of incremental policies have gradually taken effect, the economy has rebounded significantly. The "two heavy" and "two new" policies have played a key role in stabilizing investment and promoting consumption, and will be further expanded in the future.

The practice of developing new quality productivity in 2024 is fruitful, which is highlighted by "four accelerations": accelerating the improvement of innovation capabilities; accelerating the upgrading of traditional industries; accelerating the development of emerging industries; and accelerating the layout of future industries.

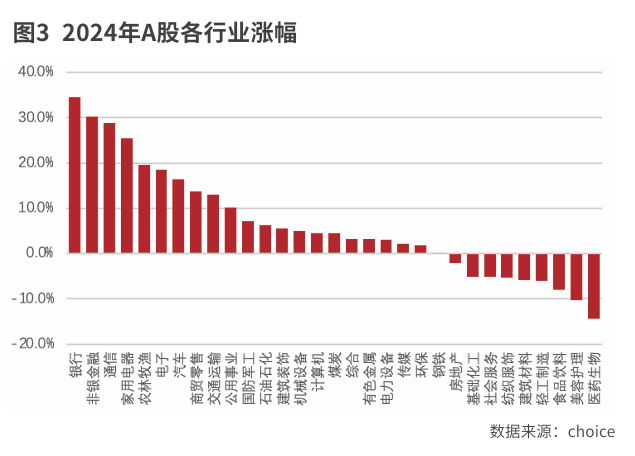

Driven by policy protection and the continued improvement of China's economic fundamentals, A shares reversed the previous two-year downward trend in 2024, and the Shanghai Composite Index rose by 12.7% in 2024. In addition, the dividends of listed companies hit a record high, and investors' sense of gain was significantly enhanced. In addition, with the solid advancement of the internationalization of the RMB, the RMB has been more widely used in cross-border transactions, and the international status and global influence of the RMB have been further enhanced.

The overall economic operation is stable

Faced with a complex and severe external environment and new situations and problems in the operation of the domestic economy, all regions and departments resolutely implemented the decisions and arrangements of the CPC Central Committee and the State Council, and intensified macroeconomic regulation. In 2024, the national economy operated generally smoothly, and high-quality development was steadily promoted. According to preliminary calculations, the GDP in the first three quarters of 2024 was 94,974.6 billion yuan, a year-on-year increase of 4.8% at constant prices.

Residents' income continued to grow, and consumption recovered steadily. In the first three quarters of 2024, the per capita disposable income of residents nationwide was 30,941 yuan, a nominal increase of 5.2% year-on-year, and an actual increase of 4.9% after deducting price factors. The income distribution structure continued to improve, and the nominal and actual growth rates of per capita disposable income of rural residents were both 2.1 percentage points faster than those of urban residents. The measures of replacing old withnew have been strengthened, driving the sales of related products such as automobiles and home appliances, and promoting the steady recovery of consumption in recent months. From January to November 2024, the total retail sales of consumer goods increased by 3.5% year-on-year, of which the average monthly consumption from September to November increased by 3.7% year-on-year, a significant increase compared with June to August.

The scale of investment continues to expand. From January to November 2024, the national fixed asset investment (excluding farmers) increased by 3.3% year-on-year. The transition between traditional growth momentum and emerging growth momentum accelerated, and the manufacturing industry upgraded and developed significantly. From January to November 2024, the investment in manufacturing increased by 9.3% year-on-year, contributing 68.1% to the growth of total investment.

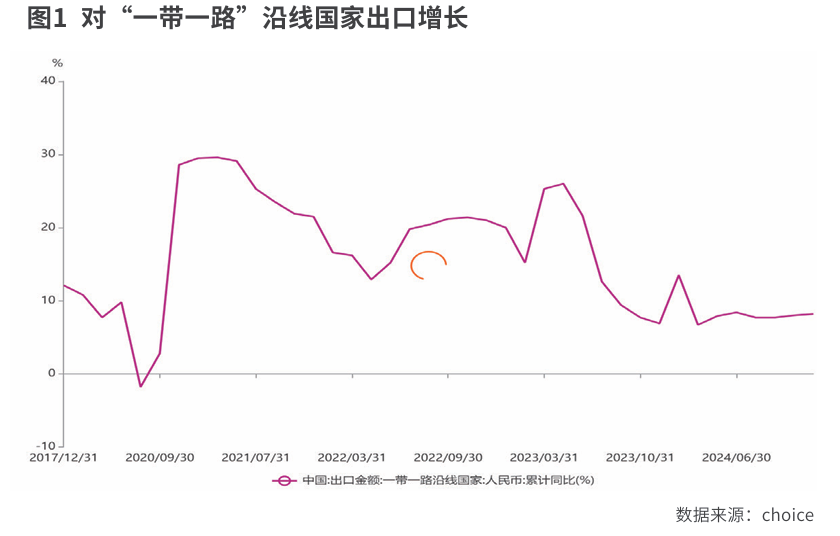

Exports maintained good growth, and the trade structure continued to optimize. From January to November 2024, the total import and export of goods increased by 4.9% year-on-year. Among them, exports increased by 6.7% and imports increased by 2.4%. In the first three quarters of 2024, the import and export of private enterprises increased by 9.4%, accounting for 55.0% of the total import and export volume, an increase of 2.1 percentage points over the same period last year. The import and export of trading partners continued to grow, and the import and export of countries participating in the construction of the "Belt and Road" increased by 6.3%, accounting for 47.1% of the total import and export volume.

The employment situation is generally stable. From January to November 2024, the average national urban survey unemployment rate was 5.1%, a decrease of 0.1 percentage point over the same period last year. In November 2024, the national urban survey unemployment rate was 5.0%, the same as the previous month. As the number of college graduates in 2024 reached 11.79 million, an increase of 230,000 from 2023, more employment was solved under the condition of overall stable economic growth, which also highlighted thecontinuous improvement of the quality of economic growth.

A series of incremental policies recently introduced to stabilize growth, stabilize the market, and stabilize expectations are playing a positive role and helping to further expand domestic demand. The incremental policies are strong and targeted. As the policy effects gradually emerge, the economy is expected to continue to stabilize and recover in the fourth quarter of 2024. The market generally expects that the economic growth rate in the fourth quarter of 2024 is expected to reach more than 5%, and the economic expectations for the whole year of 2024 will be successfully completed.

The "two heavy" and "two new" policies will be expanded

The so-called "two heavy" refers to the implementation of major national strategies and the construction of security capabilities in key areas. Issuing ultra-long-term special governmentbonds to support the construction of "two heavy" is a major measure to implement a package of incremental policies to promote high-quality economic development. The 2024 "Government Work Report" clearly stated that starting from 2024, ultra-long-term special government bonds will be issued for several consecutive years, which will be used specifically for the implementation of major national strategies and the construction of security capabilities in key areas. 1 trillion yuan will be issued first in 2024.

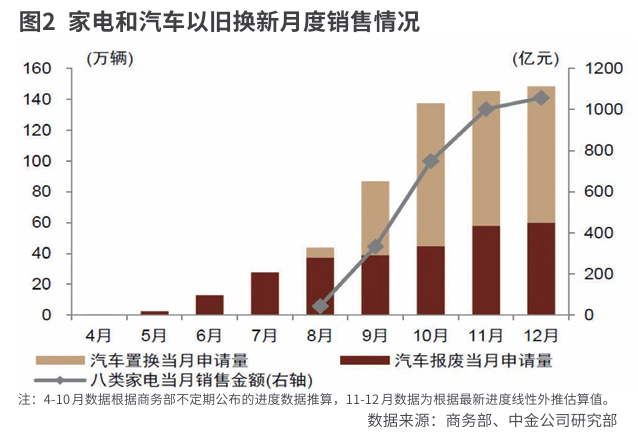

The so-called "two new" refers to promoting a new round of large-scale equipment renewal and consumer goods replacement. In February 2024, General Secretary Xi Jinping presided over the fourth meeting of the Central Financial and Economic Commission and emphasized that "a new round of large-scale equipment renewal and consumer goods replacement should be encouraged and guided." In order to implement the decisions and arrangements of the CPC Central Committee, the State Council issued the "Action Plan to Promote Large-Scale Equipment Updates and Trade-in of Consumer Goods" in March, which made specific arrangements for the implementation of four major actions: equipment update, trade-in of consumer goods, recycling and reuse, and standard improvement; in July, the National Development and Reform Commission and the Ministry of Finance jointly issued the "Several Measures to Increase Support for Large-Scale Equipment Updates and Trade-in of Consumer Goods", which coordinated the arrangement of about 300 billion yuan ofultra-long-term special treasury bonds to continuously promote the implementation of the "two new" policies.

Since the implementation of the "two heavy" and "two new" policies, positive results have been achieved, playing a vital role in stabilizing investment and promoting consumption.

From the perspective of stabilizing investment, infrastructure investment has grown steadily as the "two heavy" construction continues to advance. From January to November 2024, infrastructure investment increased by 4.2% year-on-year, 0.9 percentage points higher than total investment. Among them, investment in water conservancy management increased by 40.9%, investment in aviation transportation increased by 18.2%, and investment in railway transportation increased by 15.0%. The "two new" work has been carried out in a solid manner, demand potential has been continuously released, and investment in equipment purchase has grown rapidly. From January to November 2024, investment in equipment and tools increased by 15.8% year-on-year, 12.5 percentage points higher than total investment; the contribution rate to total investment growth was 65.3%.

From the perspective of promoting consumption, the old-for-new policy has played a major role in promoting the recovery of consumption in recent months. According to data from the National Bureau of Statistics, the year-on-year growth rate of household appliances and audio-visual equipment consumption rose to 20.5% in September, further climbed to 39.2%in October, and maintained a high growth of 22.2% in November. According to CICC's calculations, the fiscal multiplier effect of this policy is good, estimated to be around 2.5, which means that the 150 billion yuan old-for-new subsidy can drive new consumption to more than 375 billion yuan.

In the future, the "two-heavy" and "two-new" policies will be further strengthened and expanded. Yuan Da, deputy secretary-general of the National Development and Reform Commission, said at a series of press conferences on "China's high-quality economic development results" held on January 3 that the scale of ultra-long-term special treasury bondswill be greatly increased, and the implementation of the "two-new" work will be strengthened. First, expand the scope. Expand the scope of support for equipment updates to electronic information, production safety, facility agriculture and other fields. Implement subsidies for the purchase of new digital products such as mobile phones, and provide subsidies for individual consumers to purchase three types of digital products such as mobile phones, tablets, and smart watches and bracelets. Second, improve standards. Further increase the subsidy standards for the renewal of new energy city buses and power batteries, and the renewal of agricultural machinery scrapping. Increase support for the replacementof household consumer goods. Third, improve the mechanism. Further simplify the equipment renewal approval process and improve the convenience of equipment renewal for business entities. Optimize the allocation of funds for the replacement of old consumer goods, and tilt it towards regions with better work results in 2024; reduce the advance payment and operating pressure of enterprises, simplify the subsidy process, and redeem subsidy funds in a timely and efficient manner; standardize market order, strengthen project fund supervision, etc., and continuously improve policy effects.

Yuan Da also said that the issuance of ultra-long-term special treasury bonds will be increased to support the "double" construction with greater efforts. It will be promoted from threeaspects: First, increase construction efforts. Continue to support key tasks such as ecological environment protection and green development of the Yangtze River Economic Belt, the new western land-sea channel, the construction of a public service system for the urbanization of agricultural migrant population, and the quality upgrade of higher education. Expandthe scope of water conservancy support to large and medium-sized irrigation areas and large and medium-sized water diversion projects across the country; include projects such as intercity railway construction in key metropolitan areas in the scope of support; and fully implement actions to effectively reduce the logistics costs of the whole society across thecountry. Second, strengthen the combination of soft and hard. Adhere to the combination of project construction and supporting reforms, speed up the formulation of planning policies and institutional innovation, improve the investment mechanism, and enhance the comprehensive benefits of investment. Third, speed up the progress of work. On the basis of issuing a list of projects worth about 100 billion yuan in 2025 in advance in 2024, another batch of project lists will be issued in the near future to promote the formation of physical workload as soon as possible.

The development of new quality productivity has achieved remarkable results

The Central Economic Work Conference emphasized that it is necessary to coordinate the relationship between cultivating new momentum and updating old momentum, and developnew quality productivity according to local conditions. Zhao Chenxin, deputy director of the National Development and Reform Commission, concluded at the "China's Economic High-quality Development Achievements" series of press conferences held on January 3 that the practice of developing new quality productivity in 2024 is rich, vivid, and fruitful, and is highlighted by "four accelerations":

First, the innovation capacity is accelerated, and the funds such as "double heavy" and central budget investment are used in a coordinated manner to support the construction of major scientific and technological infrastructure and the renewal of old equipment, creating better conditions for the integrated development of scientific and technological innovation and industrial innovation. China's invention patent authorization volume and technology contract turnover have maintained rapid growth.

Second, traditional industries are upgraded faster, and the action plan for the core competitiveness of the manufacturing industry is implemented in depth. The high-end, intelligent, and green development of the manufacturing industry has continuously achieved new results. In the first 11 months of 2024, the investment in manufacturing technology transformation increased by 8.5%, which is significantly faster than the growth of total investment.

Third, emerging industries will accelerate their development, and the national strategic emerging industry cluster development project, the "East Data West Computing" project, and the industrial innovation project will be deeply implemented. In the first 11 months of 2024, the added value of high-tech manufacturing above the designated size increased by 9% year-on-year, significantly faster than the growth of industrial enterprises above the designated size.

Fourth, the layout of future industries will be accelerated to support the construction of new scenarios in the fields of artificial intelligence, biomanufacturing, future energy, quantum technology, etc. As of the end of November 2024, the National Emerging Industry Venture Capital Guidance Fund has participated in 501 sub-funds, driving fundraising of 288.54 billion yuan and supporting 8,946 start-up and early and mid-stage enterprises. These are very obvious progress and results.

The development of new quality productivity will make greater progress on the basis of achievements and experience in 2024. In future work, Zhao Chenxin pointed out that we should pay attention to grasping several important aspects: First, we should adhere to local conditions more. Support all regions to explore new ways with regional characteristics based on their strategic positioning and combined with their endowment advantages. For example, in the construction of large-scale wind power and photovoltaic bases in deserts and Gobi deserts, the industrial chain is extended by developing new energy storage, green electricity hydrogen production, and developing green hydrogen derivatives. Second, we should adhere to integrated development. We should support the deep integration of scientific and technological innovation and industrial innovation, the real economy and thedigital economy, and constantly give birth to new industries, new models, and new momentum. For example, we should carry out the "artificial intelligence +" action in depth, support the application of renewable energy and new energy storage technologies, and build zero-carbon parks, zero-carbon communities, and zero-carbon villages. Third, we should adhere to deepening reform. We should deepen the reform of the economic system and the scientific and technological system, and promote the formation of production relations that are more compatible with the development of new quality productivity. For example, we should optimize the institutional arrangements such as market registration, trading mechanism, and measurement and settlement, support various business entities to participate in the electricity market, and provide development space for new formats suchas virtual power plants and smart microgrids. At the same time, we should pay more attention to preventing a rush, preventing the neglect and abandonment of traditional industries, and preventing homogeneous competition caused by blind development.

The international status of RMB is steadily improving

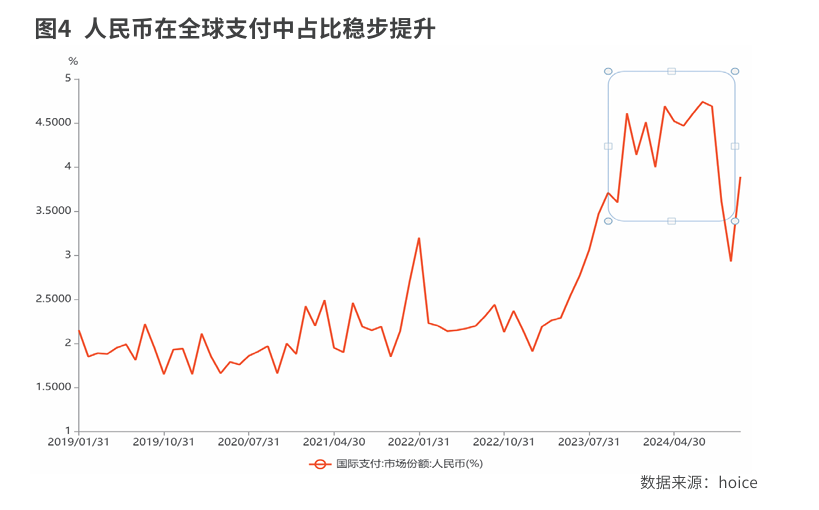

With the solid progress of RMB internationalization, a better policy and market environment will be created for domestic and foreign entities to hold and use RMB. RMB is more widely used in cross-border transactions, and its international status and global influence are further enhanced.

The scale of cross-border use of RMB has grown steadily, and the proportion and ranking of RMB in global payments have increased. From January to August 2024, the total amountof cross-border RMB receipts and payments was 41.6 trillion yuan, a year-on-year increase of 21.1%. According to data from the Society for Worldwide Interbank Financial Telecommunication (SWIFT), in August 2024, the proportion of RMB in global payments was 4.69%, and it has been the world's fourth largest payment currency for ten consecutivemonths since November 2023.

RMB cross-border receipts and payments in the commodity trade sector have maintained rapid growth. From January to August 2024, the total amount of RMB cross-border settlements in major commodity trades was 1.5 trillion yuan, a year-on-year increase of 22.7%. China has listed 24 international futures and options products such as crude oil and iron ore, introduced overseas traders, and provided pricing benchmarks for RMB-denominated settlements in commodity transactions. In 2023, the total trading volume of crude oil futures of Shanghai Futures Exchange was 49.546 million lots, with an average daily trading volume of 205,000 lots and an average daily position of 65,000 lots. It is theworld's third largest crude oil futures after West Texas Intermediate (WTI) and Brent crude oil futures.

The proportion of RMB in international reserves is generally stable. According to data from the International Monetary Fund (IMF), as of the end of the second quarter of 2024, the scale of RMB reserves held by global central banks was US$245.2 billion, accounting for 2.14%, an increase of 1.07 percentage points from 2016 when RMB just joined the SDR, ranking seventh among major reserve currencies.

In addition, in the IMF Special Drawing Rights (SDR) currency basket, the weight of RMB has risen to 12.28%, ranking third after the US dollar and the euro.