China PMI Index Operation

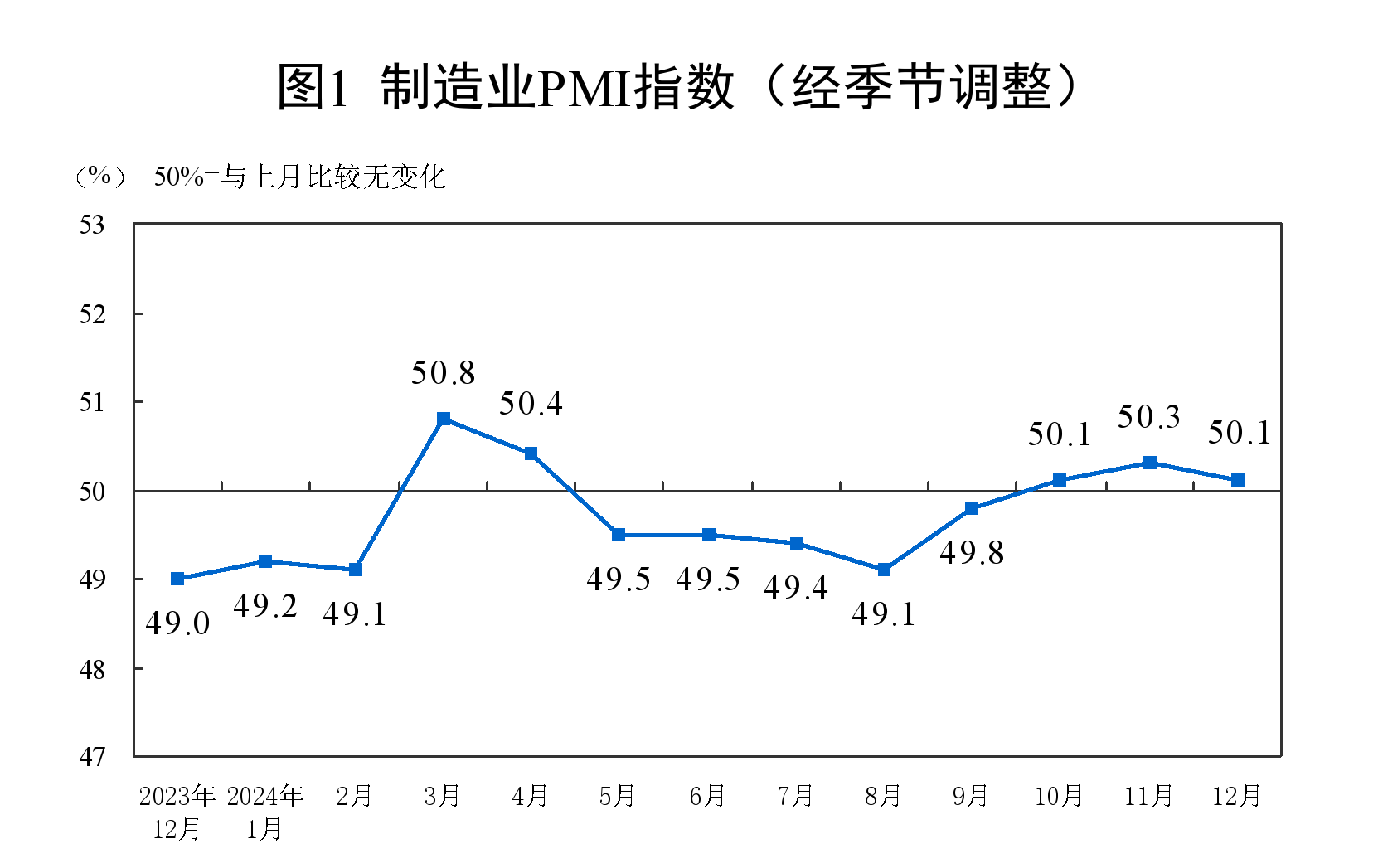

In December, the manufacturing Purchasing Managers' Index (PMI) was 50.1%, down 0.2 percentage points from the previous month, and the manufacturing industry continued to expand.

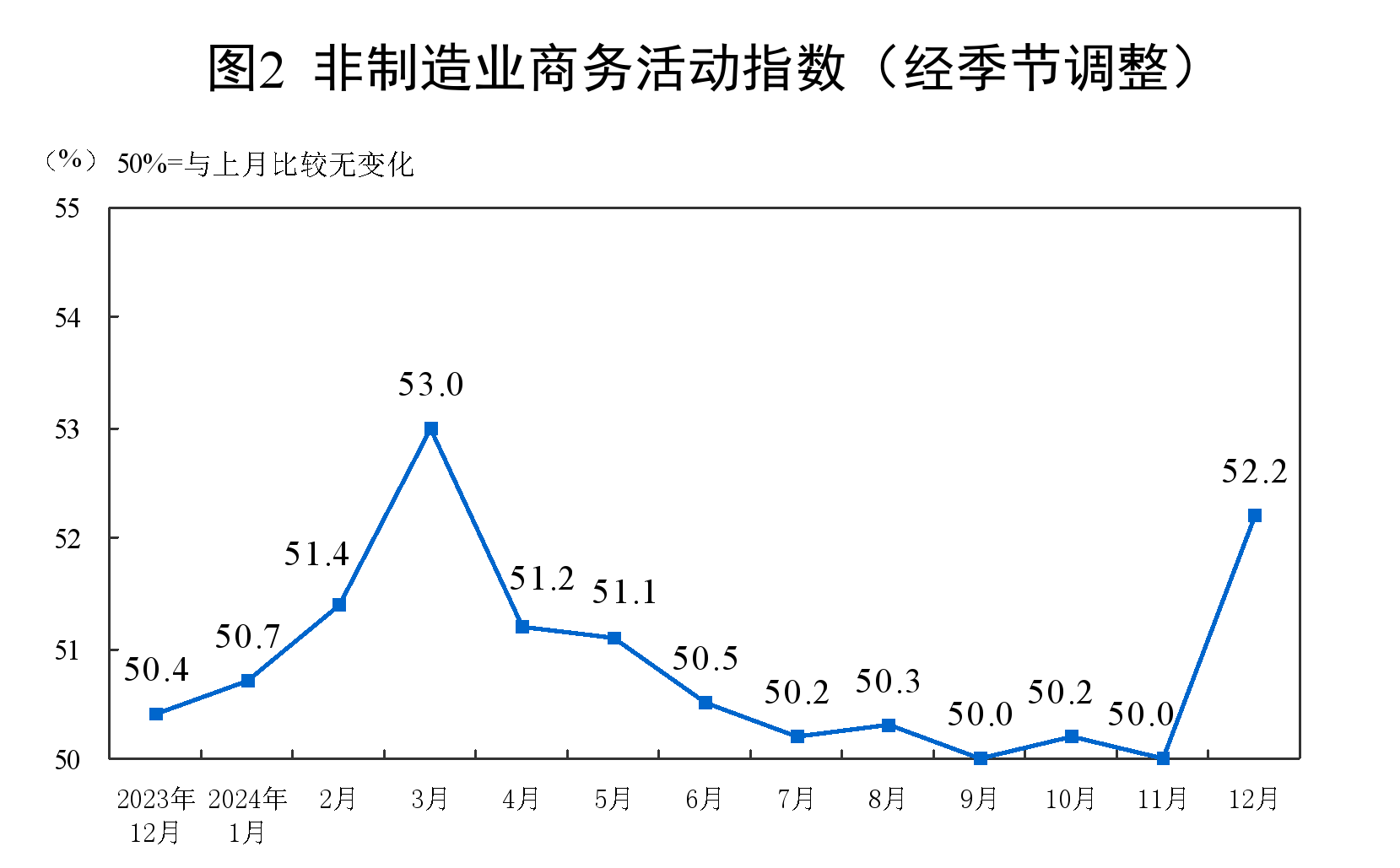

In December, the non-manufacturing business activity index was 52.2%, up 2.2 percentage points from the previous month, and the non-manufacturing industry's business climate has rebounded significantly.

In December, the composite PMI output index was 52.2%, up 1.4 percentage points from the previous month, indicating that the overall expansion of my country's enterprises' production and operation activities accelerated.

The manufacturing purchasing managers' index has maintained expansion for three consecutive months

In December, China's manufacturing purchasing managers' index was 50.1%, which has remained stable in the expansion range for three consecutive months. With the further implementation of stock policies and a package of incremental policies, the overall market demand has shown a stable and accelerated recovery trend. The new order index in December was 51%, up 0.2 percentage points from the previous month, and has risen for four consecutive months. Exports also continued to stabilize, and the new export order index rose for two consecutive months.

Zhang Liqun, a special analyst at the China Federation of Logistics and Purchasing, believes that the PMI index fell slightly in December, but still remained on the prosperity and decline line, indicating that the economy continued to show a recovery trend, but faced greater pressure. The order index increased slightly, but the ex-factory price index continued to fall, indicating that although there are signs of recovery in demand, the problem of total imbalance of oversupply is still serious. Affected by this, the production index and the production and operation activity expectation index have both decreased. Overall, the factors that promote economic recovery and the market-led demand contraction and economic downward pressure are at a critical moment of mutual struggle.

Among the five sub-indices that make up the manufacturing PMI, the production index (52.1%, down 0.3 percentage points from the previous month), the new order index (51.0%, up 0.2 percentage points from the previous month) and the supplier delivery time index (50.9%, up 0.7 percentage points from the previous month) are above the critical point, while the raw material inventory index (48.3%, up 0.1 percentage points from the previous month) and the employee index (48.1%, down 0.1 percentage points from the previous month) are below the critical point.

Zhou Maohua, a macro researcher at the Financial Market Department of Everbright Bank, believes that the manufacturing PMI index continued to be in the prosperity range in December, and the slightly slowed pace of manufacturing expansion is related to the off-season of manufacturing. From the perspective of the five sub-indicators, the demand for manufacturing has improved, production has maintained expansion, and corporate operating expectations have remained optimistic. This is mainly due to the gradual release of the effects of the policy combination punches such as large-scale equipment renewal and consumption trade-in. Overseas demand expansion has driven the demand for my country's export-oriented manufacturing industry. my country's high-tech and equipment manufacturing industries have maintained a high level of prosperity and their share has steadily increased. In the past three months, the manufacturing boom has continued to improve, reflecting that the economic recovery momentum in the fourth quarter has significantly increased under the support of domestic macro policies.

"However, judging from the sub-item indicators, the domestic manufacturing demand is relatively weak. With the improvement of industry production efficiency and fierce competition in the same industry market, the overall ex-factory price of the manufacturing industry is still shrinking. In the absence of a significant expansion of demand, the sluggish prices may squeeze the profits of some industries and enterprises, and affect the willingness of some industries to expand production and investment." Zhou Maohua said.

Wang Qing, chief macro analyst of Orient Securities, also said that the decline in the manufacturing PMI index in December was mainly affected by seasonal factors, but driven by the continued effectiveness of stock policies and a package of incremental policies, the manufacturing PMI index has been in the expansion range for three consecutive months. In addition, the recent overall upward trend of the construction and service industry PMI indexes shows that the economic boom in the fourth quarter is significantly better than that in the third quarter. Specifically, the decline in the manufacturing PMI index in December was first of all due to certain seasonal factors: in the previous 10 years, the manufacturing PMI index in December fell by 7, remained unchanged by 1, and rose by 2. Behind this is the approaching of important festivals, and the production activities of enterprises will generally slow down. In addition, the manufacturing PMI index turned downward in December this year, mainly due to the decline of the production index by 0.3 percentage points to 52.1%. This is consistentwith the fact that the operating rates of major industries or sectors such as steel, cement, automobiles, and infrastructure in the same month showed a certain degree of month-on-month decline. The price levels of consumer goods and industrial products are still low recently, and the overall market demand has limited driving effect on production; at the same time, it is not ruled out that the increase in external uncertainties in 2025 is exerting a certain inhibitory effect on the production of manufacturing enterprises.

It is worth noting that both price indices in the manufacturing PMI in December fell sharply, among which the ex-factory price index fell by 1.0 percentage points to 46.7%, and the mraw material purchase price index fell by 1.6 percentage points to 48.2%, both of which were in a deep contraction range. "On the one hand, this is related to the transmission of downward trends in international commodity prices such as crude oil, copper, and aluminum to the domestic market that month. On the other hand, it is mainly affected by the recent continued downward trends in domestic prices of basic raw materials such as steel, coal, and chemicals, indicating that the current overall market demand is still weak. This shows that the overall economic recovery in the near term is still relatively mild, and the recovery in market demand has limited pulling effect on industrial product prices. The reason behind this is that the current round of fiscal debt-to-equity policies is very strong, but it will take some time for the boosting effect on local governments' ability to stabilize growth to be transmittedand the recovery in the property market has not yet been transmitted to the real estate investment end." Wang Qing said.

The non-manufacturing business activity index rebounded significantly

In December, the non-manufacturing business activity index was 52.2%, up 2.2 percentage points from the previous month, and the non-manufacturing business climate has improved significantly. In the fourth quarter, the average non-manufacturing business activity index was 50.8%, up 0.6 percentage points from the third quarter.

Huo Lihui, director of the Enterprise Prosperity Department of the Service Industry Survey Center of the National Bureau of Statistics, said that among the 21 industries surveyed, 17 business activity indexes were higher than last month, and the industry prosperity also generally rebounded. Among them, the business activity indexes of aviation transportation, telecommunications, radio and television, and satellite transmission services, monetary and financial services, and insurance industries have all risen to a high prosperity range of more than 60%, and the total business volume of related industries has grown rapidly.

In addition, affected by factors such as the approaching Spring Festival holiday, some companies rushed to seize the construction progress, and the construction industry business activity index was 53.2%, up 3.5 percentage points from the previous month. From the perspective of market demand, the new order index has risen to the expansion range for the first time this year, and the confidence of construction companies in the recent industry development has continued to increase in the past three months.

Cai Jin, president of the China Federation of Logistics and Purchasing, believes that in December 2024, the non-manufacturing business activity index was 52.2%, an increase of more than 2 percentage points from the previous month; the new order index was 48.7%, an increase of nearly 3 percentage points from the previous month, indicating that both supply and demand in the non-manufacturing industry have changed positively. Driven by the rise in both supply and demand, the operation of the non-manufacturing industry has shown a linkage change in prices and corporate employment, and market confidence has continued to increase. The input price index rose to more than 50%, the sales price index was the same as last month, the employee index rose slightly, and the business activity expectation index continued to rise for 3 months. The average values of the above indexes in the fourth quarter were higher than those in the third quarter.

"The business activity index and new order index of the construction industry have both risen to more than 51%. The housing construction industry and civil engineering construction industry have both performed well, indicating that the delivery of buildings and infrastructure construction activities are improving." Cai Jin said that the business activity index and new order index of the retail industry, accommodation industry, catering industry, and cultural and sports entertainment industry have all increased to varying degrees compared with the previous month, reflecting that consumption-related activities have rebounded. It is expected that New Year's Day holiday consumption will continue to drive the above-mentioned industry activities to stabilize and rebound. The business activity index of railway transportation, air transportation and postal industries are all above 55%, and have increased significantly compared with the previous month, indicating that corporate business exchanges and residents' social exchanges are becoming more active. The business activity index and new order index of the financial industry have both achieved a month-on-month increase for two consecutive months, both rising to more than 60%, which means that the financial support for the real economy continues to increase. In the fourth quarter, the average business activity index of the non-manufacturing industry was 50.8%, up 0.6 percentage points from the third quarter. The operating trend of the non-manufacturing industry is better than that of the third quarter, laying a good foundation for the steady progress of the economy in 2025.

Macroeconomic prosperity is expected to continue its upward trend

Zhou Maohua believes that the improvement in the prosperity of the service industry PMI index in December also reflects the effectiveness of large-scale countercyclical adjustment policies in China and the improvement of market expectations. Domestic consumption promotion policies have driven the expansion of consumption and service demand; the improvement of social expectations and the recovery of financial market sentiment have driven the recovery of demand for financial products and services. At the same time, the issuance of domestic government bonds has accelerated and the implementation of projects has been accelerated, and the pace of expansion of construction activities has accelerated.

"From the trend point of view, manufacturing activities will fluctuate in the next 1-2 months due to traditional festivals and other factors, but it is expected that domestic manufacturing activities will continue to recover as a whole. The main reason is that there is still a lot of room for the effects of the introduction of a package of macroeconomic policies, and the demand in the manufacturing market is expected to gradually recover; the real estate industry has shown signs of stabilization, and the domestic high-tech equipment manufacturing industry has maintained a high prosperity, and overseas demand has maintained a certain resilience." Zhou Maohua said.

Wang Qing judged that the prosperity of the manufacturing industry in the fourth quarter was at a relatively low level in the expansion range, indicating that the current economic operation is in a state of mild recovery. This is also confirmed by the fact that the price level in the fourth quarter is still relatively low. The reason behind this may be related to the need for further repair of market confidence.

Looking ahead, Wang Qing said that the manufacturing PMI index will continue to be in a state of moderate expansion in January 2025. Against the backdrop of macroeconomic policiesemphasizing "more proactive and effective", various measures to boost consumption and stabilize investment will be implemented faster at the beginning of next year, thereby supporting the prosperity of the manufacturing industry. In addition, the trend of the domestic real estate industry will also be a key factor in determining the trend of the manufacturing PMI. Overall, the manufacturing industry will continue to be in a state of moderate expansion in January 2025.